Green hydrogen is considered a crucial solution to decarbonise ‘hard-to-abate’ sectors and, whilst some commentators suggest it will be available for ~$0.5 /kg – a cost level that is infeasible in our view – we don’t believe it will be available for <$3 /kg (real 2022) at the point of use, even in 2050. $3 /kg is equivalent to ~$80 /MWh, higher than natural gas prices today and 6x higher than pre-energy crisis, steady-state thermal coal prices.

In our view, projections of $0.5 /kg costs do not stand up to rigorous, techno-economic assessment. Such low-cost projections are misleading because they imply that no great change to the economics of the global energy system is needed and that the energy transition will be easy. While CRU believes that green hydrogen will play a major role in the energy transition, the switch to hydrogen will necessarily lead to significantly higher energy prices and this will have ramifications on the economy, the competitiveness of different sectors and on how consumers spend their money.

CRU provides a credible and independent view of costs and technology development vital for the energy transition. This Insight is one in a series highlighting this work.

Green hydrogen is key for achieving net zero by 2050

Various countries and regions have set up ambitious goals for clean hydrogen production in the coming decades as part of their net zero roadmap. For example, in September 2022, the United States Department of Energy (DOE) identified opportunities for 10 Mt/y of clean hydrogen production by 2030 and 50 Mt/y by 2050 in its draft National Clean Hydrogen Strategy and Roadmap. In May 2022, the EU announced its target of reaching 20 Mt/y of renewable hydrogen use by 2030 in the REPowerEU plan and, in March 2019, the Ministry of Economy, Trade and Industry of Japan (METI) targeted a “one-fourth cost” for water electrolysis equipment – from $1,500 /kW installed capacity to $380 /kW by 2030 – in its Hydrogen and Fuel Cell Roadmap.

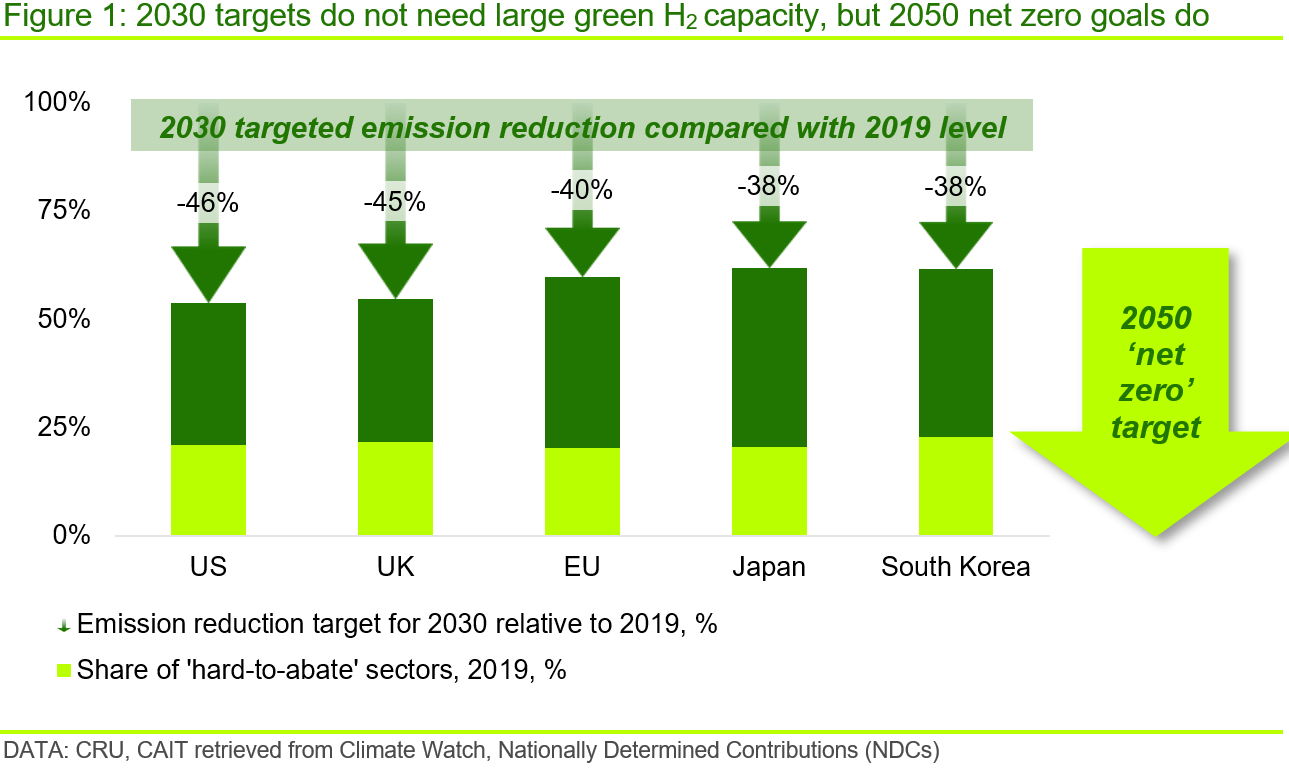

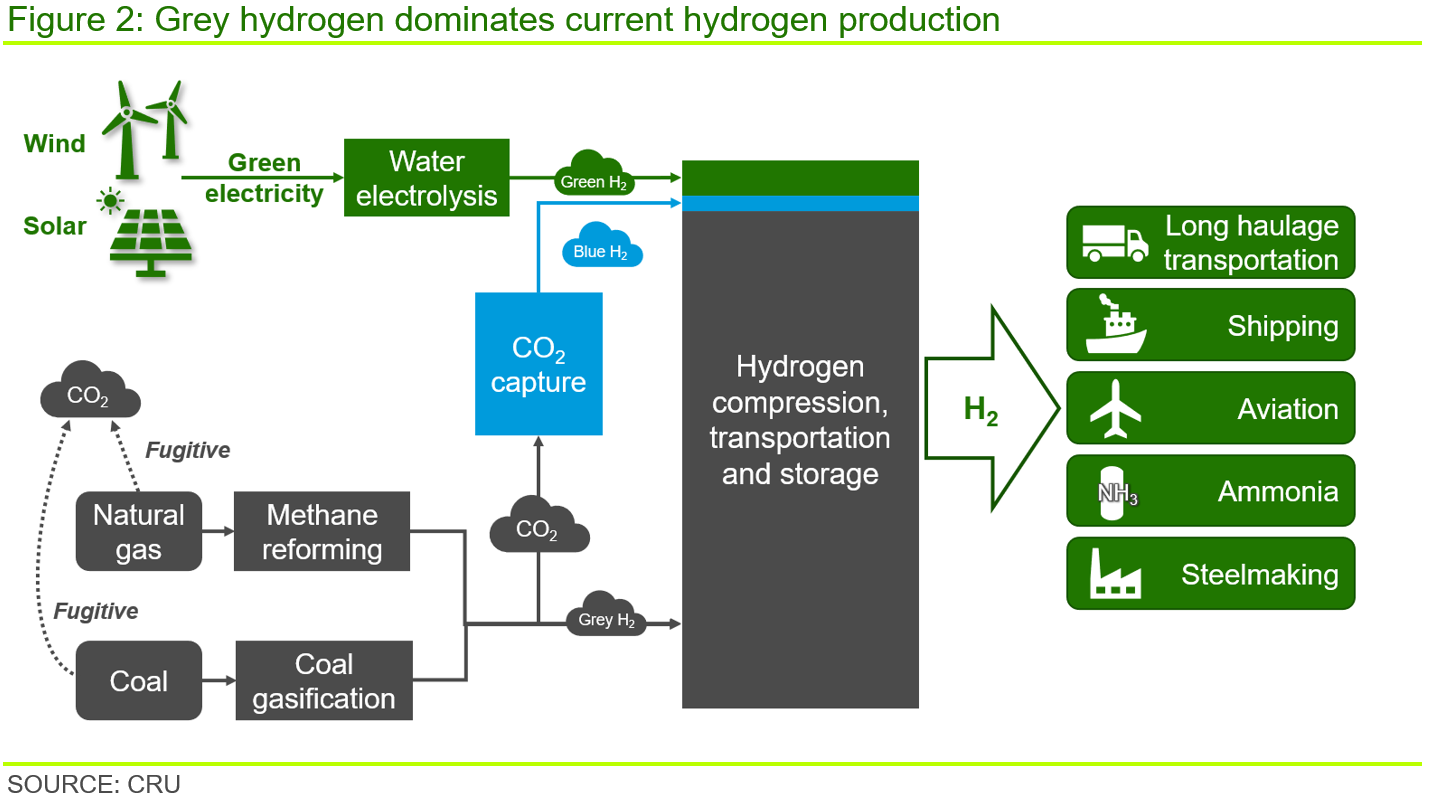

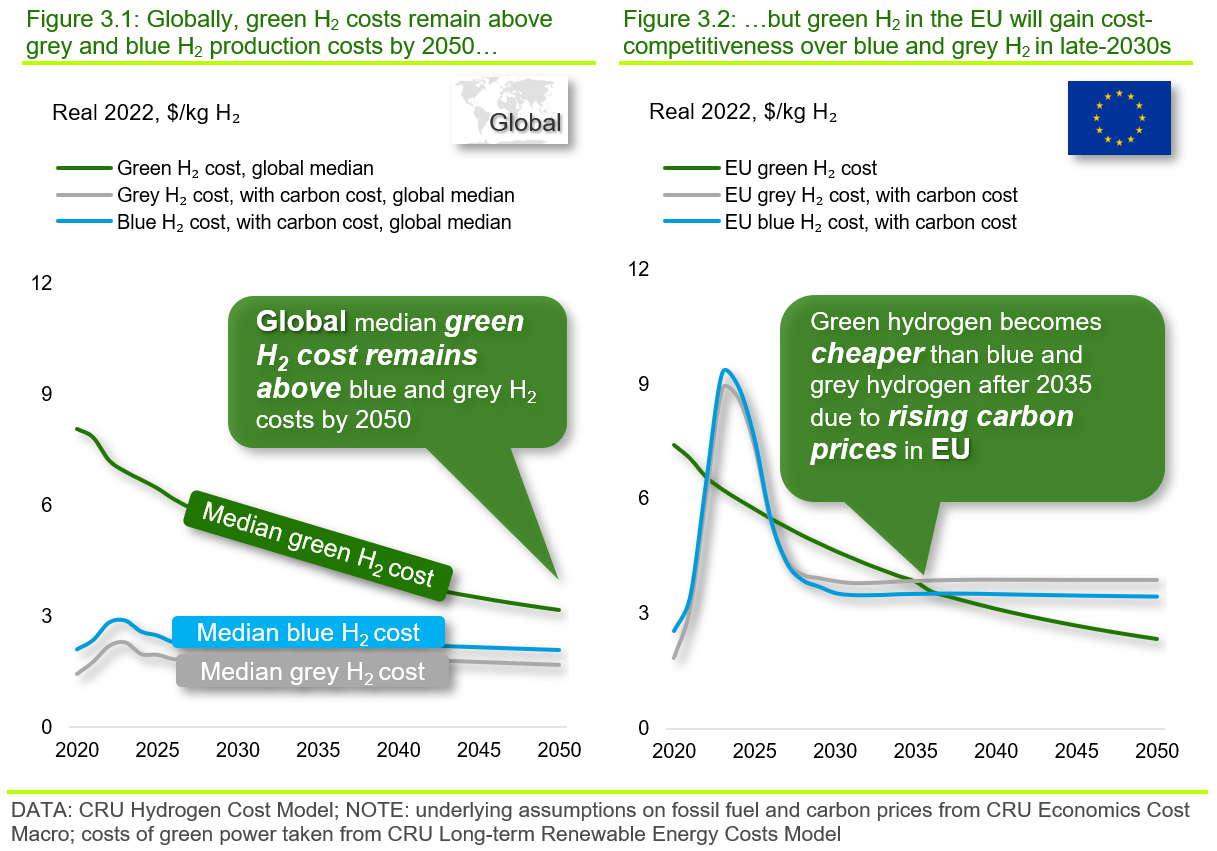

Although large-scale deployment of green hydrogen is not necessarily a prerequisite for the achievement of each country’s 2030 announced pledges, green hydrogen is an essential component in the 2050 net zero roadmaps of most developed nations.

Green hydrogen uses green power to produce hydrogen through electrolysis and this route accounts for ~1% of current global hydrogen production. The rest is predominantly grey hydrogen that is produced from methane or coal through natural gas reformation or coal gasification. Blue hydrogen refers to hydrogen derived from fossil fuels but where reforming/gasification plants are coupled with carbon capture facilities.

Long haulage transportation, shipping, aviation and industrial sectors such as steel and ammonia can utilise green hydrogen to mitigate carbon emissions by 2050.

Green H2 at $0.5 /kg is unrealistic, even by 2050

Green hydrogen cost projections of ~$0.5 /kg have been cited by many commentators in recent years and costs below $1 /kg routinely proposed, sometimes stated as achievable as early as 2030. However, in our view, costs this low are unrealistic. Rather, it is our belief that the $0.5 /kg cost aspiration has been put forward less because it is the result of a rigorous assessment of the relevant technologies but simply because it aligns with the pre-energy crisis, steady-state cost of thermal coal (i.e. ~$3.5 /GJ). That is, hydrogen at this cost level implies that no great change to the economics of the global energy system is needed and so is intended to imply that the energy transition is easy and little sacrifice is required to make it happen. This is untrue – under a decarbonised future, energy costs will necessarily be higher than we have been used to.

CRU’s Hydrogen Cost Model, which builds on our long-term renewable energy costs research, finds that, even for green hydrogen production facilities in very favourable renewable energy locations, ~$2 /kg is already a stretch goal for 2050. This is equivalent to a 50–70% fall from current levels, depending on country, and is largely due to halved renewable power costs and a 75% reduction in electrolyser system capex. It should be noted, this $2 /kg cost is quoted on a ‘net ex-works’ basis. It assumes a cost-free connection of the renewable power source directly to the electrolyser and omits the hydrogen storage, compression and distribution costs that would need to be added to reflect the full cost at point of use (n.b. see further on for more details).

Further, apart from the EU, the UK and China, which are expected to have access to low-cost renewable energy by 2050 and/or relatively high carbon prices, most countries exhibit green hydrogen costs above blue and grey hydrogen costs by 2050.

Even $1.5 /kg will be an extreme stretch target for green H2

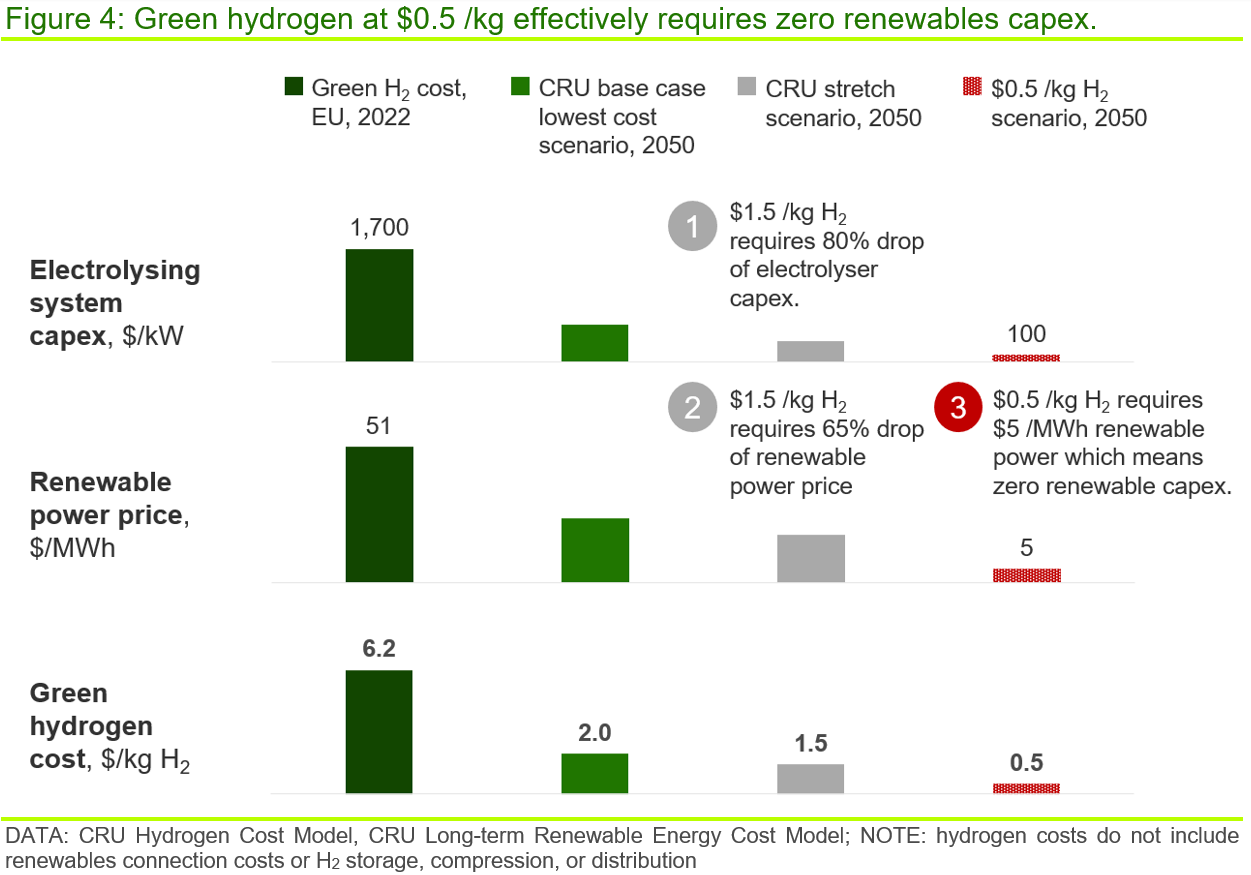

In CRU’s most optimistic case, green hydrogen costs could drop to ~$1.5 /kg by 2050 (n.b. net ex-works, with no power connection cost or H2 storage, compression, or distribution costs), a price that puts green hydrogen broadly on a par with grey and blue hydrogen in most regions. However, to achieve this, the scale of cost improvements needed is significant, requiring an 80% cost reduction of system capex. and 65% reduction of renewable energy costs as illustrated in Figure 4. The electrolyser would need to be able to deal with a fluctuating electricity supply with a 54% utilisation rate (i.e. no battery storage is assumed, as this is costly). A number of these assumptions are challenging.

For example, renewable energy at ~$18 /MWh requires an average renewable capex. of ~$300 /kW for both wind and solar operating at their largest load factor potentials. Assuming a grouping of solar and wind – which provides the most favourable power output profile for an electrolyser – the $1.5 /kg scenario is asking for a 70–80% capex. reduction in the next three decades. Note that, according to IEA, although the capex. of solar has dropped by ~50% over the past eight years, a period of rapid costs decreases, the capex. for onshore wind fell by only ~10%.

To achieve $0.5 /kg, even if we assume electrolyser system capex. drops to $100 /kW in 2050 (i.e. by 95%) and other operating costs fall, renewable power costs would have to fall to $5 /MWh – a price level that doesn’t cover any of the renewables capex. That is, the renewables capex. would need to be zero to achieve a power price of $5 /MWh, which is infeasible.

Received price of green H2 likely >$3 /kg (real 2022) in 2050

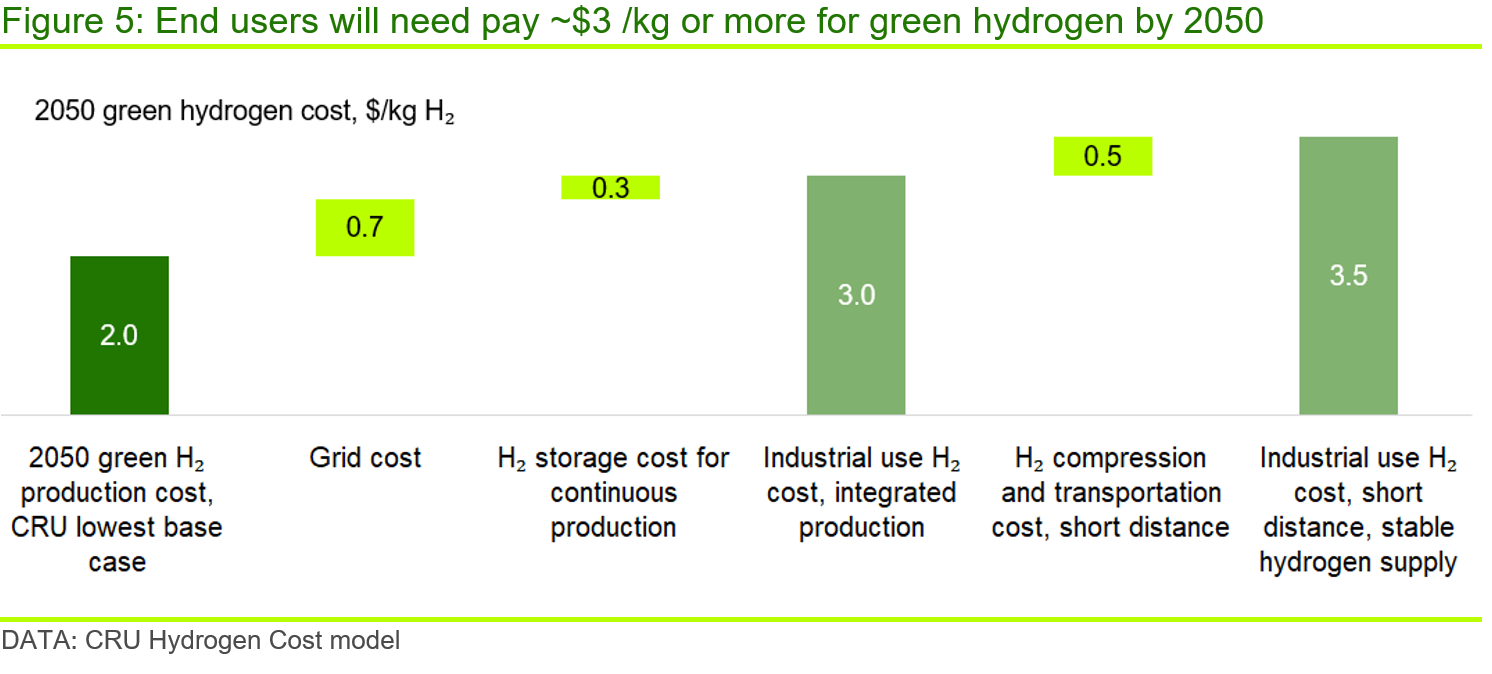

We don't believe a ‘net ex-works’ price of below $2 /kg H2 (real 2022) is feasible and, in addition to this, we would expect further costs associated with an electrical grid or renewables connection – even for a local grid – as well as hydrogen storage, compression and distribution. Taking these costs into account, the total green hydrogen cost to a typical end-user is expected in the range ~$3–7 /kg (real 2022) in 2050.

‘Renewable-to-electrolyser’ interconnectors could add ~$0.7 /kg

While a typical, full grid charge (i.e. assuming an electrolyser facility takes power via a grid after purchasing renewable power directly) might add ~$2.5–3.0 /kg to the cost of hydrogen, a more likely scenario is the direct connection of nearby, but differently located solar and wind resources (i.e. a mix that provides the flattest power profile) to a central electrolyser via interconnectors. According to CRU’s Interconnector Database, this could add ~$0.7 /kg, on average, to the cost the green hydrogen production.

Storage, compression and distribution costs could add further ~$0.8 /kg or more

Compression and transportation of hydrogen over 100–200 km can add $1–3 /kg if using trucks, as is mostly the case currently. However, the best-case scenario for 2050 includes the large-scale deployment of hydrogen pipelines operated at a high utilisation rate that could bring costs down within the range of $0.1–2 /kg, depending on distance. Some level of storage will also be required, and this could add a further ~$0.3 /kg.

As such, at best, sectors such as the transportation and aviation that would need a distributed hydrogen supply are expected to have to bear a ‘best’ cost/price closer to ~$3.5 /kg (real 2022). This cost includes a renewables connection cost and hydrogen storage, compression and transportation, and assumes a short distance between the hydrogen production facility and the user’s hydrogen refuelling station. Separately, the lowest possible cost for industrial green hydrogen users, such as steelmakers or green ammonia producers, could be closer ~$3.0 /kg, provided plants are fully integrated with green hydrogen production facilities such that shipment costs are negligible. A cost of ~$2.0 /kg, as quoted above, is only applicable if a renewable connection charge is exempted, no storage is required and hydrogen is used directly after production, which itself would engender its own set of challenges.

Green hydrogen is the only zero emission hydrogen among current options

The other possible carbon emission mitigation solution for ‘hard-to-abate’ sectors seems to be blue hydrogen, which is sometimes also quoted as ‘clean’. By 2050, based on our forecasts for fossil energy prices, blue hydrogen is expected to have lower cost compared with green hydrogen overall. However, blue hydrogen is not an emission-free hydrogen production route. In fact, the lowest possible emission intensity of blue hydrogen, assuming continued fugitive emissions of methane along the full natural gas supply chain, will be ~30% that of natural gas. That is, 1 t of blue hydrogen will still be responsible >2 t of carbon dioxide emissions.

If the world is going to rely heavily on green hydrogen to achieve its net zero target, ‘hard-to-abate’ sectors will face much higher energy costs in 2050.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more