In this insight we lay out the key implications of decarbonisation and the energy transition for commodity markets and companies. Green technology costs will fall but there remains much hype, hope and hyperbole about the trajectory of technology development. Decarbonisation is vital, but it will be expensive and it will be challenging – beware forecasts that suggest otherwise.

This is the first of a two-part series examining decarbonisation. The second part builds on the themes here and focuses on carbon pricing, why it is needed and how it will drive wholesale change.

CRU continues to provide credible, transparent and independent data and views on sustainability, energy transition technologies and their impact on commodity markets. If you want to hear more, please get in touch.

What decarbonisation means for commodity markets

It is too simplistic to look at 2050 pledges and, given the timescale, assume little change is needed now. Sustainability and decarbonisation are affecting markets today and the impacts will only become more acute. The need to tackle climate change, and limit its physical effects, is driving growing pressure to decarbonise and enable a sustainable economy. Policies to achieve this will have an increasingly important impact on businesses, markets and economies. Delays in decarbonising risk a more disorderly and costly transition down the road, or a failed transition, where physical climate change risks pose existential risks to civilisation. Governments, producers, traders, consumers and financial players will need to factor the increasing impacts of climate change into their investment decisions and business planning.

Currently, much pressure is being felt in terms of reporting requirements, particularly from supply chain partners, financials or other stakeholders wanting to know a supplier’s carbon footprint that can then be compared with its peers. However, much of this work today is simply reporting on ‘business as usual’ conditions and many companies have yet to embark upon the hard changes needed to hit decarbonisation targets. As reporting requirements formalise to include short-, medium- and long-term targets and milestones, they will become more onerous and sophisticated, but the need for real action will also become more apparent.

In fact, a closer examination of government pledges, or Scope 3 targets from downstream sectors, such as automakers, reveal many promises for large-scale emission reductions as early as 2030 that will rely on major changes across the commodities sector. The combination of increased transparency through reporting and near-term publicly stated targets will drive shifts in foundational industries.

Some commodities, such as copper, lithium or nickel, will see demand driven higher as we shift from a fossil fuel-intensive to a minerals-intensive energy system. But this will create challenges in how commodity demand can be met in a sustainable way.

To hit climate pledges, some commodity value chains will need to see widespread decarbonisation in their production processes. This will require significant research and development spending but ultimately huge investments. Companies need to start planning for this now. The pressure is here already and it is only set to grow. Increasingly, companies throughout the supply chain will have to start showing that they are delivering on their decarbonisation commitments.

The scale of the challenge is huge

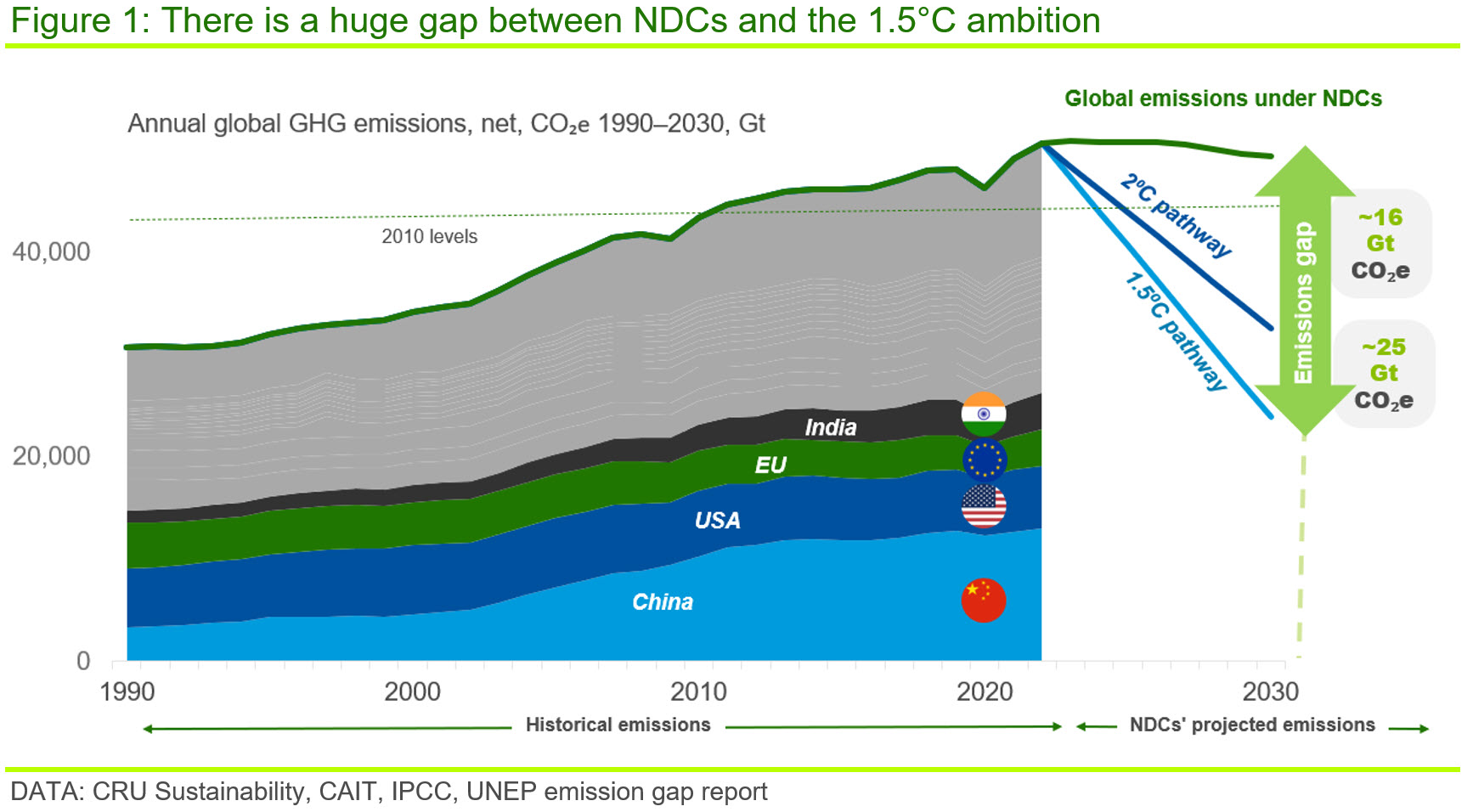

To understand the scale of the challenge for the commodities sector, we need to provide context. Current global greenhouse gas emissions (GHG) are over 50 Gt of CO2e (n.b. includes CO2, CH4, N2O etc., normalised to CO2 equivalents) and the accumulation of these gases in the atmosphere is causing global temperatures to rise. But there is a maximum amount of CO2 that we can put into the atmosphere (i.e. the ‘carbon budget’) and significant reductions in emissions are needed by 2030 and beyond to avoid the most disastrous consequences of climate change. Because of the carbon budget, the more we emit today, the more rapid action that will be needed in the future. However, there is a huge gap between what governments have pledged in their National Determined Contribution’s (NDCs) and the scope of emissions cuts needed to realise the 1.5°C or 2°C ambition and emissions continue to rise.

To limit global warming to 1.5°C, emissions need to roughly halve by 2030 and the world needs to achieve net-zero by 2050. The window for successfully decarbonising economies is limited and this is why an acceleration in climate ambition will be needed – we will see the ratcheting up of climate ambition and pledges as the effects of climate change become more apparent.

A reliance on high-level pledges and voluntary action will be insufficient and policymaking will be vital to achieving climate goals. This is why there is an increasing quantity of regulation to drive decarbonisation and we should expect carbon pricing, explicit or implicit, to become more prevalent.

Why commodities value chains are called ‘hard-to-abate’

Fundamental changes to the supply side of various commodity value chains, particularly aluminium, fertilizers and steel, will be extremely challenging. These commodities are ‘hard-to-abate’ for various reasons but essentially it is because there is no ‘slot in’ technology available to decarbonise them. In these sectors, change cannot just focus on electrification, they require a complete transformation of the production process. However, the technologies needed do not exist at scale today, are unproven or are prohibitively expensive.

Steel accounts for ~8% of global GHG emissions and faces a huge decarbonisation challenge, mainly due to its scale: global production in 2022 was 1.9 bn t of crude steel. This is why the steel value chain has been subject to policymakers’ scrutiny.

Most emissions from steel come from the chemical reaction between coal and iron ore to convert it into to steel – that is, CO2 is at the core of that chemical reaction – so decarbonisation needs a complete reimagining of the steel production process to use lower carbon alternatives, such as green hydrogen.

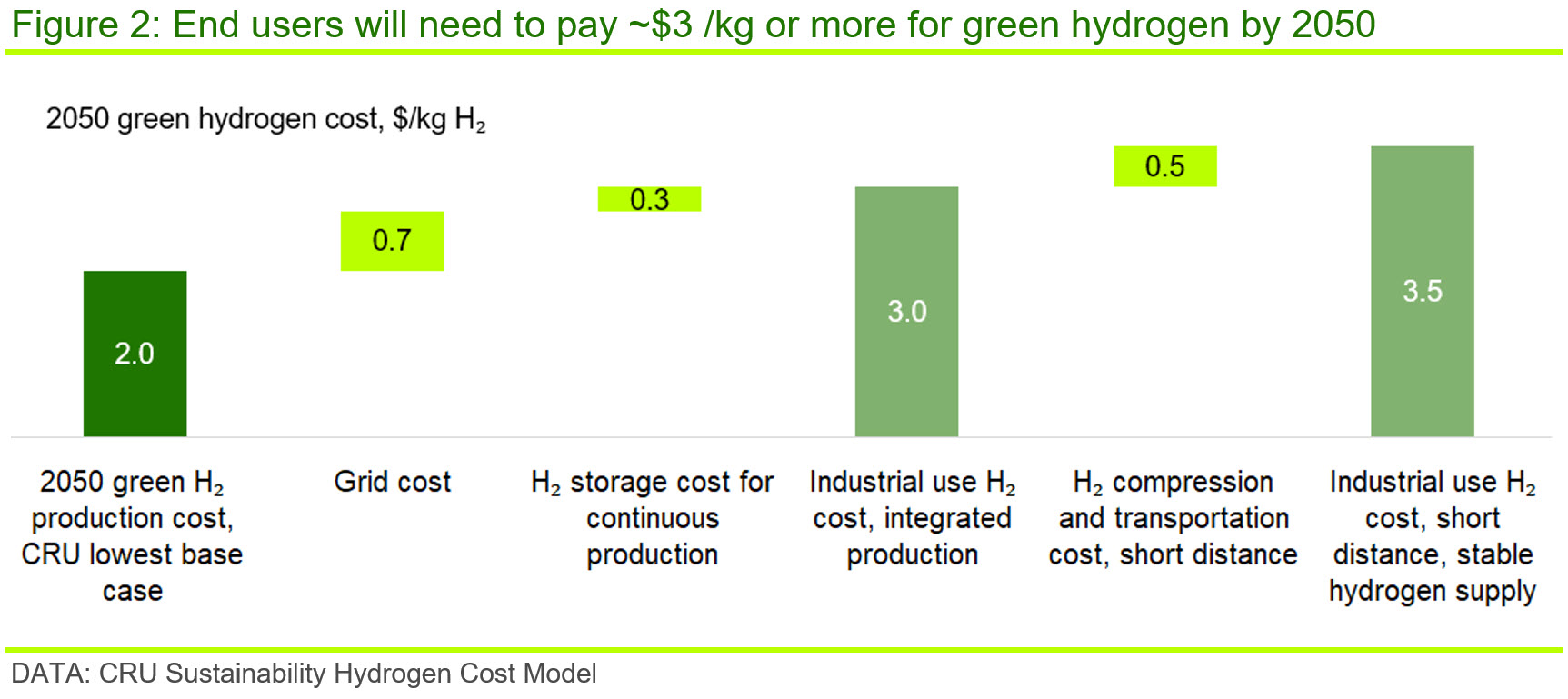

But these greener processes are expensive. Steel plants will need to be rebuilt to include hydrogen-based technologies, which might cost more than five-fold the cost of a traditional steel plant when you include the renewable power needed to support hydrogen production. Further, the costs of green hydrogen are far above the cost of coal or natural gas, the main reductants used today. Green hydrogen costs $6–8 /kg currently and even by 2050 we do not expect that to fall below $3 /kg, equivalent to a four to five-fold increase in the cost of the main reductant. Moreover, the raw materials needed to support hydrogen steel production – specifically high-grade iron ore pellet – are not available in the quantities needed. Decarbonisation in steel cuts right across the value chain.

Primary aluminium production is a comparatively smaller industry, with production of 69 Mt in 2022. The challenge in this value chain is largely about access to energy both in terms of quantity and cost. Globally, an average of ~14 MWh of electricity is used to produce one tonne of primary aluminium and there are significant emissions associated with this process. Global average emissions on a Scope 1 and 2 basis are 10.7 tCO2e/t of primary aluminium, or about five times the average emissions intensity of steel.

The power needed to produce aluminium comes from a range of sources including renewables, nuclear, natural gas and coal and, compared to blast furnace-basic oxygen furnace carbon crude steel production, there is a wide emissions range, from 2–20 tCO2e/t of primary aluminium. Approximately 2 tCO2e comes from the production and consumption of anode; therefore, even moving entirely to renewable power does not eliminate emissions and, like the steel sector, some major process changes will be needed. Key technologies to achieve deep decarbonisation, such as inert anodes, remain in the pilot stage and carbon capture and storage (CCS) will be challenging to apply to aluminium and expensive.

There will need to be some technological innovation, of course, but we cannot rely on that wholly and producers will need to be imaginative in their business models. Changes to production processes need to be started today and producers need to position themselves for more wholesale change in the future to mitigate the risk of missteps and mistakes.

Changing energy markets is central to decarbonisation

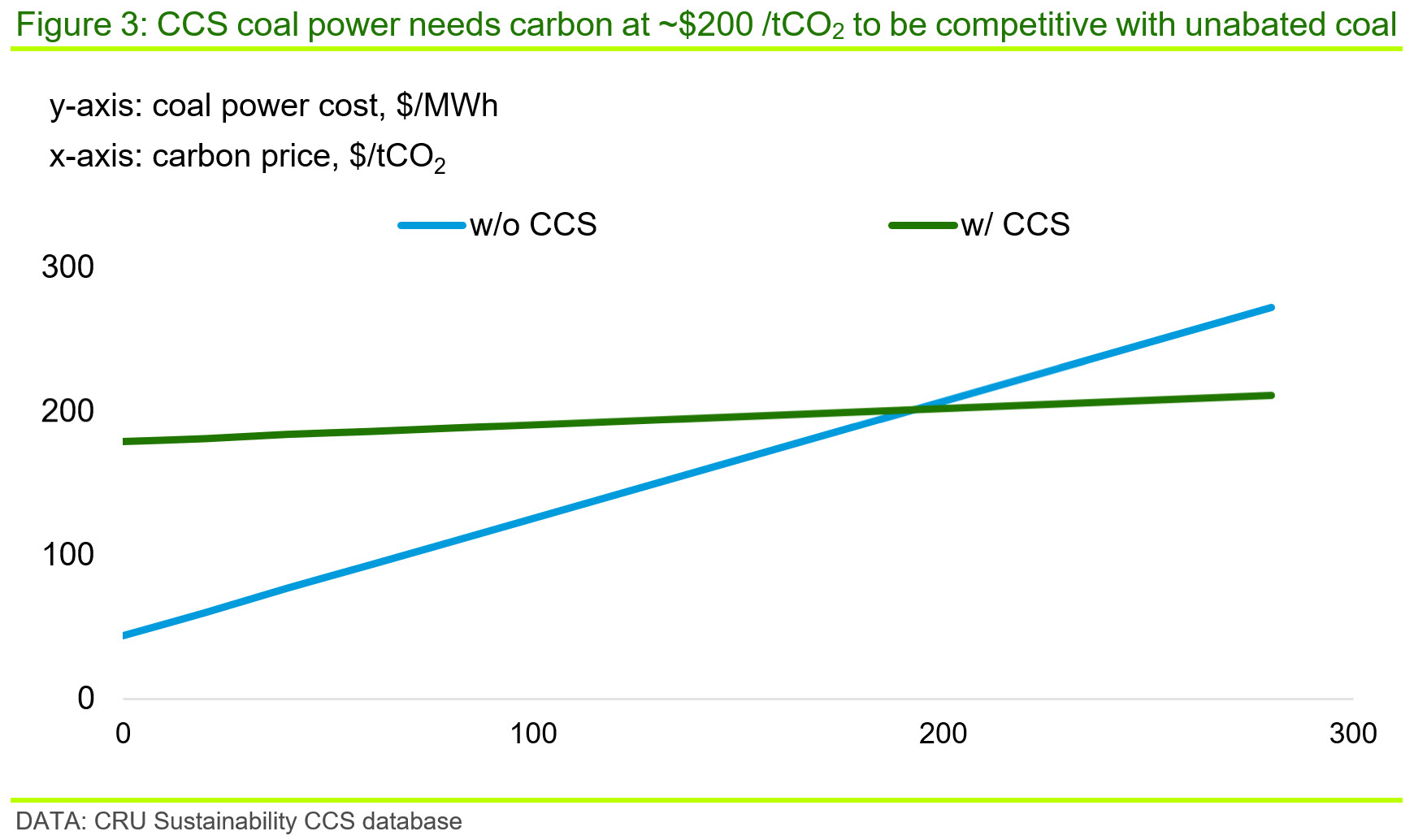

Ultimately, in a decarbonised future, most of our energy will need to come from renewable energy. CRU’s modelling suggests CCS associated with power generation is unlikely to be a core solution, it looks expensive and largely unproven at commercial scale and may struggle to get the investment needed to move up the learning curve. However, CCS associated with hydrogen production will see more traction. The unit capex. of a carbon capture facility can vary significantly, which is largely driven by different characteristics of the off-gas or tail gas from which the CO2 is captured.

If we look across the four major emitting sectors, power, transport, industry and agriculture, the power sector will face the greatest pressure over the next decade. Power and heat accounted for ~40% of total global carbon emissions in 2021, the single biggest sector. Moreover, it is logical to focus here as the electrification of economies is the lynchpin of a green economy, providing the basis for hydrogen production, decarbonisation of steel, the power for electrified transport and home heating, etc. In short, decarbonisation of other sectors cannot progress unless we invest in the grid upfront. We will see electricity consumption as a proportion of primary energy growing rapidly. Transitioning the power grid also plays to concerns about energy security.

Further, the technologies already exist today to replace fossil-based power (e.g. solar, wind etc.) and renewable installations have grown significantly, with global capacity almost doubling since 2018 and annual increases in renewable capacity outpacing that of coal and gas since 2015.

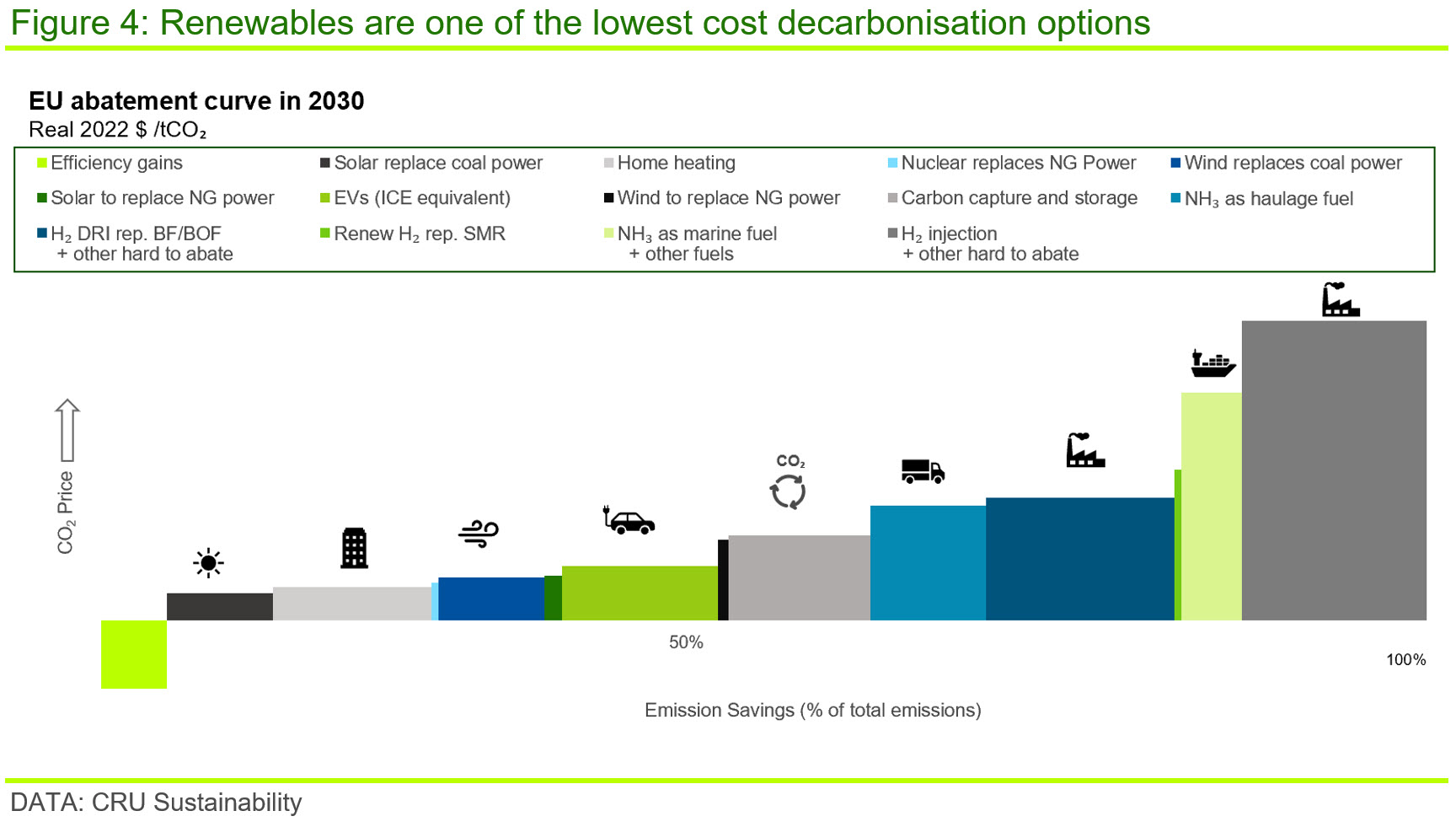

In that sense, the power sector is, comparatively, an ‘easy-to-abate’ sector as slot in technologies are available. However, emissions here will need to fall at around twice the pace of hard-to-abate sectors if the world is to get close to being aligned with a 1.5°C or 2°C pathway. Spending should be concentrated where most reductions can be achieved at lowest cost, which will take pressure off the carbon budget and give harder-to-abate sectors more time to find the best solutions.

Yet, a decline in emissions from the power sector of ~11% per year implies a five-fold increase in renewables capacity by 2030 to supply the current and growing grid. Moreover, there will be large additional power requirements needed to support green hydrogen production and green ammonia production also. That is a huge challenge and goes far beyond what CRU’s base case projects.

Hard truths need to be recognised; emissions must be priced for green technology to flourish

The scale of the incoming change is vast. Many factors, such as material availability or political will, need to be addressed but CRU believes that costs are the most central issue.

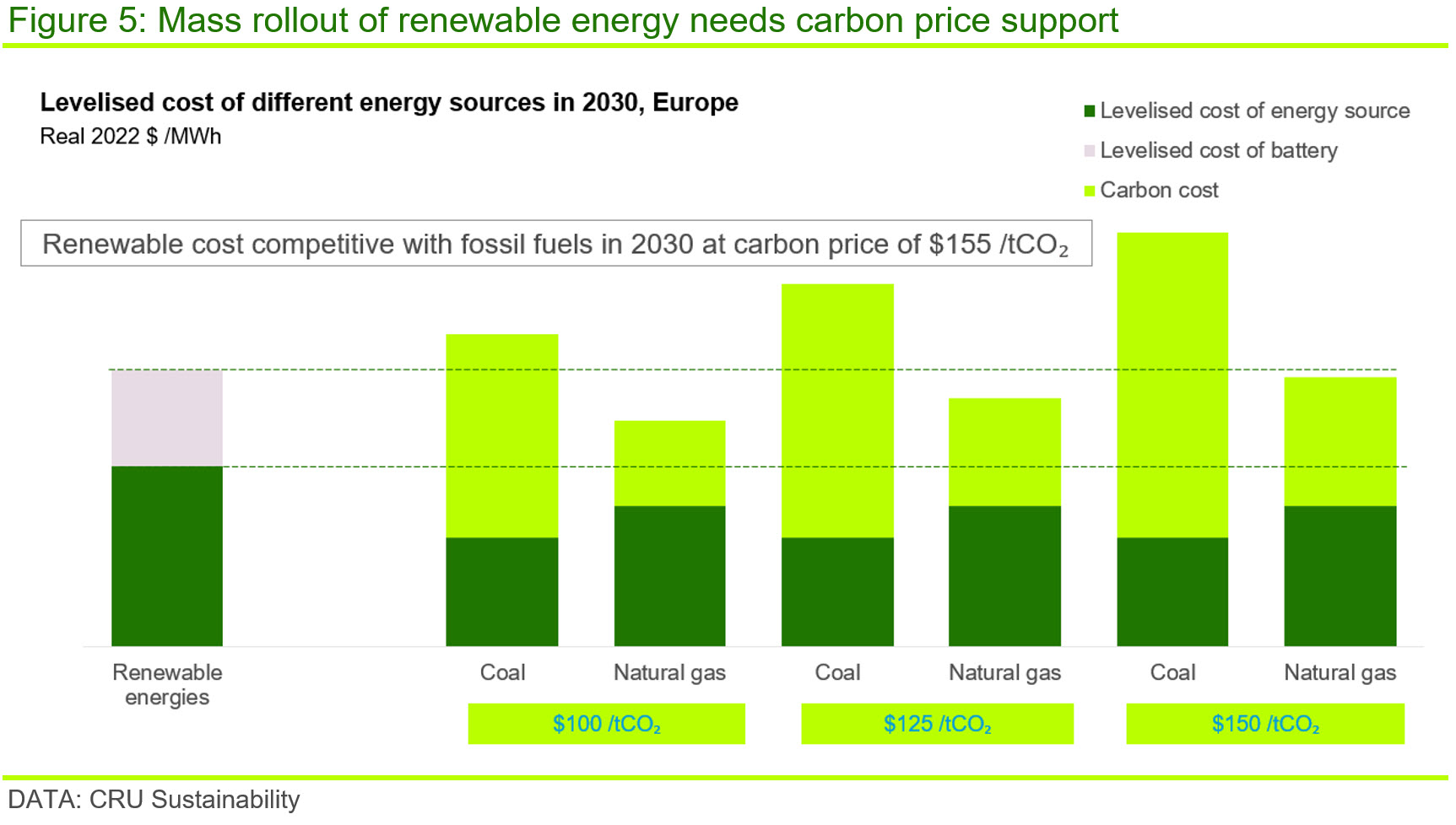

Many commentators say renewable energy is now universally the cheapest form of power and that hydrogen will only cost $0.5 /kg or $1.0 /kg in the future. However, CRU’s analysis does not support these projections. In a fully, or largely, decarbonised grid, direct costs of energy will be higher in the future than we have seen historically, and the true costs of decarbonisation must be understood to enable proper planning and investment now.

When looking at renewables, the cost of storage and grid strengthening needs to be considered as a minimum, which lifts real world costs significantly. At the same time, fossil fuels have negative externalities that are largely un-costed and also receive subsidies. Within this landscape, renewable energy can universally compete with fossil fuels, but only once a realistic explicit, or implicit, carbon cost is applied to recognise these factors; carbon pricing is needed to drive widespread decarbonisation.

Because of this, CRU forecasts that hydrogen is unlikely to be available for less than $3 /kg (real 2022), even in 2050 and assuming large-scale cost reductions in renewable energy and significant technological improvements. As a key source of energy, this cost is far above what we have been used to.

For steel, aluminium and other hard-to-abate sectors, because of these cost impacts, it is hard for a single company to unilaterally make a switch to a low-emission process. They would be at a cost disadvantage. Thus, to incentivise change, businesses need policy support from carbon pricing, subsidy or mandates or to see their product preferentially priced. But this is not easy or cheap meaning the world is not achieving the emissions reductions it needs to stay aligned with the Paris agreement.

For commodities, the longer the world community delays action, the more of the remaining carbon budget will be used by easier-to-abate sectors. Hard-to-abate sectors will have less time to adapt and put in place the needed infrastructure and investments. This will make it more difficult and costly to decarbonise economies later and raises the risk of future transition or climate shocks. Delaying the transition will mean that more is needed to be done in a shorter period, resulting in more draconian and costly measures. Furthermore, if key infrastructure is not in place and nascent technologies are not commercialised there will be fewer and more costly decarbonisation options.

Decarbonisation is vital, but it will be expensive and difficult

For companies that already feel under pressure to decarbonise, this is nothing to what is incoming. We are wildly off track to hit our 1.5°C emission targets. The need to take bigger steps will become ever more apparent and hard-to-abate sectors will be extremely exposed due to the relatively high capital intensity of abatement technologies and long lead times to deploy them.

Governments will increasingly look to drive decarbonisation and in our view carbon pricing will be central to this. Companies need to be ready for that, and one aspect of that readiness is access to credible, reliable data.

The implications of decarbonisation and the energy transition for commodity markets are huge. Green technology costs will fall but this is still an area where there is much hype, hope and hyperbole. Rapid decarbonisation is vital and the costs and consequences of failing to act will increase markedly. However, decarbonisation is often expensive and difficult – beware forecasts that suggest otherwise.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more