CBAM, while improving the situation for EU steel mills, will lock in cost and competitive disadvantage, as well as carbon leakage, for a decade. It does not ‘level the playing field’ for EU mills and we argue the policy is not fit for purpose, never mind ‘fit for 55’.

CBAM fails to ‘level the playing field’ for steelmakers

The EU is committed to reducing GHG emissions by 55% below 1990 levels by 2030 and targets climate neutrality by 2050. Additionally, it recognises that, “whilst other countries do not have the same level of climate ambition”, there is a risk of carbon leakage (i.e. whereby production is transferred to countries with less stringent climate policy). For those sectors at risk, carbon leakage is currently mitigated via free allocations of EUA and/or financial measures to compensate for emission costs passed on in electricity prices. However, it is also recognised these mechanisms weaken the price signal to incentivise decarbonisation; CBAM has been proposed to address carbon leakage by “ensuring equivalent carbon pricing for imports and domestic products”. We believe, rather than create a level playing field, CBAM will lock in cost disadvantage – and carbon leakage – for EU steel mills. This outcome results from a misunderstanding about both the impact of carbon costs on average and marginal costs and the basis of competition between domestic and imported steel.

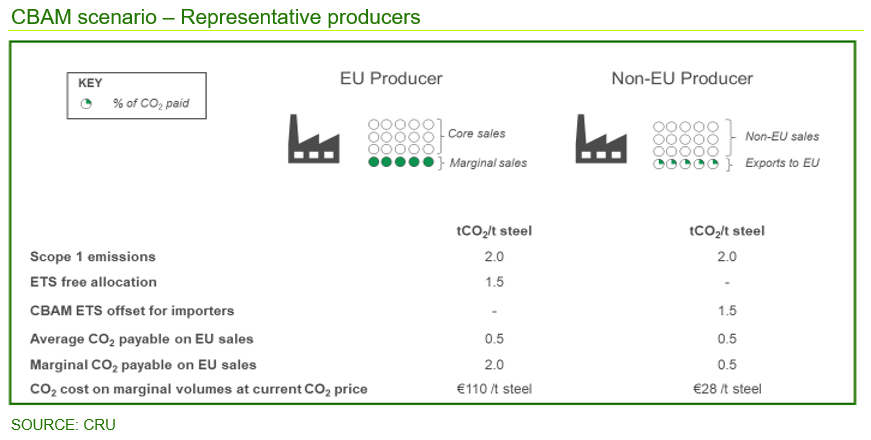

CBAM purposefully reflects the workings of EU ETS

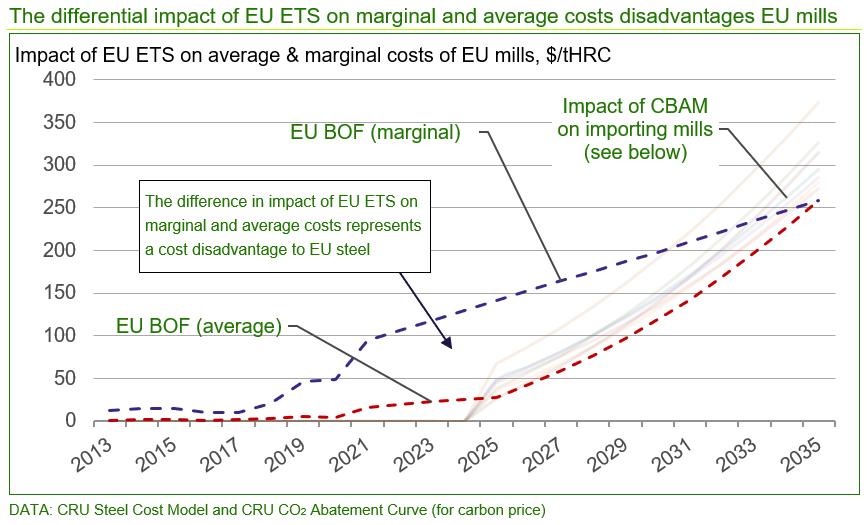

To ensure a ‘level playing field’, CBAM is designed to closely resemble the EU ETS, such that domestic steelmakers and importers are exposed to equivalent carbon costs. From 2025, importers will need to declare the ‘embedded emissions’ in their steel and, based on the difference between these emissions and those covered by free allowances, they must surrender CBAM certificates. Importantly, imports will benefit from the same level of free allowances as domestic mills and the price of CBAM certificates will be linked to the EU ETS. However, while this rationale is appropriate when considering the average carbon costs that EU producers face, the logic breaks down when considering marginal costs.

As part of the ‘Fit for 55 package of measures’, from 2025, the level of free allowances will be reduced annually such that, by 2035, no further free allowances will be available either to domestic producers or importers (n.b. above, this is the point when the impact on marginal and average costs is the same). We would argue that, only in 2035 will the CBAM truly reflect a ‘level playing field’ but, up to this point, the difference in impact on marginal and average costs representments a cost disadvantage to EU steel industry.

The marginal and average cost conundrum

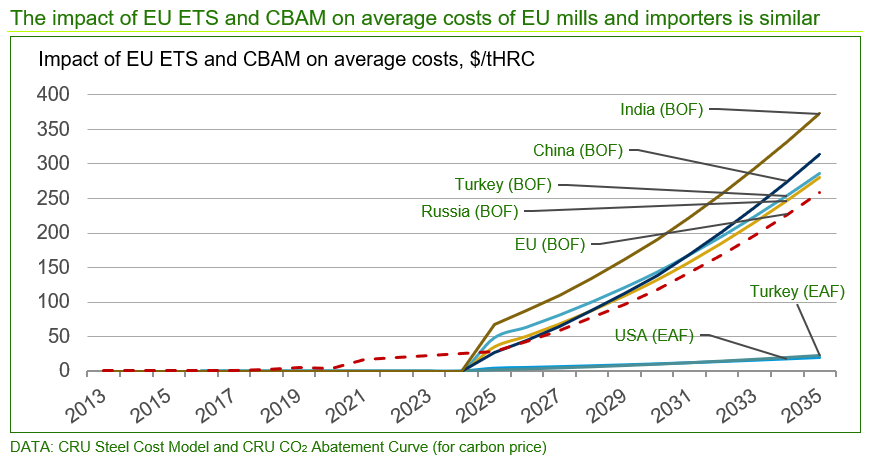

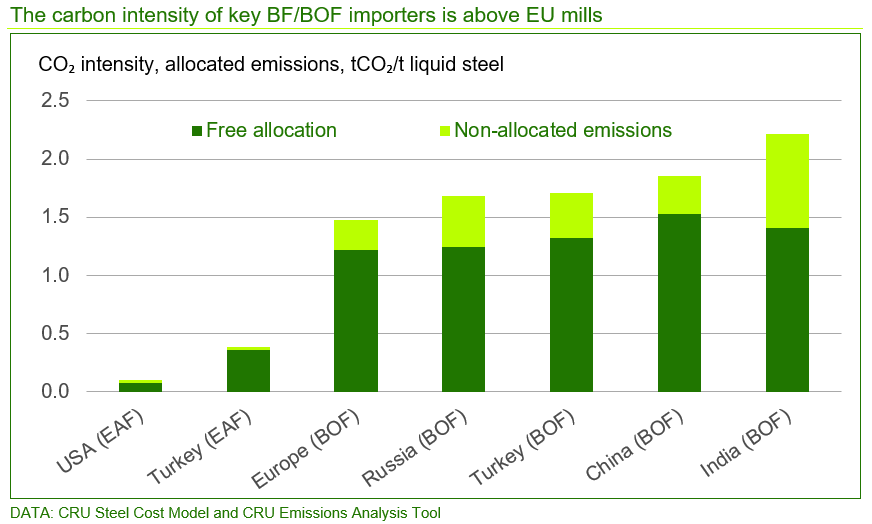

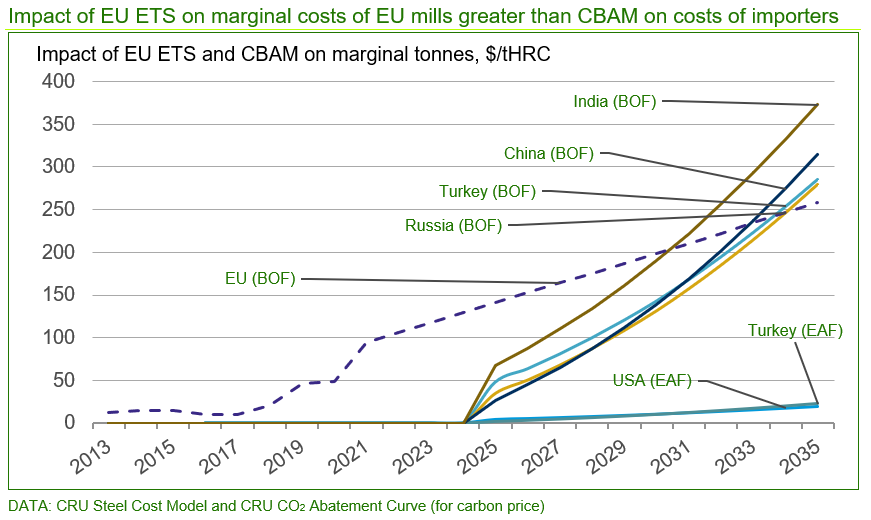

In the chart below, we have estimated the impact of the CBAM on average costs of steel mills based in several importing countries out to 2035 and of the EU ETS on EU domestic mills over the same period. This calculation considers the emissions associated with the median-emitting EAF or BF/BOF steel mill producing hot rolled coil in each country/region, the expected level of free allowances after applying the same rules that apply to EU steel producers, expected reductions in free allowances – to zero in 2035 – and carbon price. We have also assumed some reduction in carbon emissions over this period but, in all instances, the same rate of emission reduction has been applied. This latter assumption might be considered to disadvantage the higher emitting mills today (e.g. India) that will have greater scope to reduce their emissions through process improvement.

The chart shows that CBAM will lift importers’ average costs from 2025, typically above the cost of EU ETS on EU domestic mill average costs, with this difference largely due to higher emissions associated with importing mills. EAFs that produce hot rolled coil will see costs lift by a much lower amount, again due to the lower emissions associated with EAFs. This could be regarded as ‘levelling the playing field’ to some degree, as the apparent disadvantage experienced by EU steel mills since 2018, when the CO2 price began to lift significantly, will reverse.

The picture looks somewhat different when marginal costs are considered.

Marginal costs are important as it is the marginal tonnes produced by EU mills that compete directly with imported steel (i.e. marginal tonnes are typically sold into logistically distant and competitive markets, into general sales and with little customer ‘relationship’). Free allocation only covers a proportion of emissions, therefore all EU marginal tonnes are exposed to the full carbon cost (i.e. carbon price multiplied by the emission intensity, which is typically just under ~2 tCO2/t steel). However, imported steel is only charged at the average rate, as described above. When we plot a similar chart, but reference the impact on marginal costs for EU mills, a very different conclusion can be drawn.

While the impact on imported costs is unchanged from previously, the impact of EU ETS on EU mill marginal costs is higher. Thus, while EU steel producers will be better off than today from 2025 onwards, from when importers will be charged something, their marginal tonnes remain highly disadvantaged and will remain so until the free allocation is eliminated.

What the marginal cost disadvantage means in practice

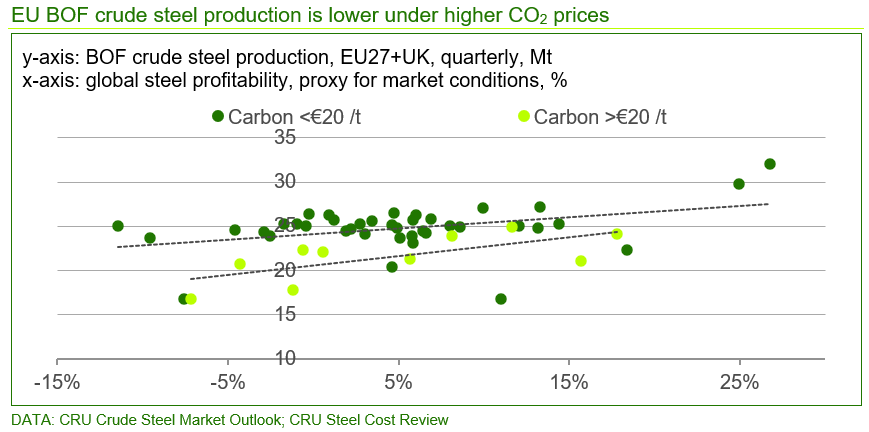

We have reported previously on the impact the marginal cost disadvantage has on the ability of EU steel mills to compete and the real-world effects on production and profitability of the EU steel industry. The chart below shows that EU crude steel production via the BF/BOF route has not returned to historical levels – under given market conditions – since the CO2 price has been >€20 /t, averaging ~10% below historical levels. We argue this is because EU mill marginal production is less competitive at higher CO2 prices and so mills cannot produce [and sell] the same volumes into the more distant and competitive markets. As a result, these volumes have been taken by imports, which represents real carbon leakage in the steel sector today. We also believe overall profitability of the EU steel sector has been reduced by ~15–20% relative to steady-state levels as a result of this effect. The CBAM, while improving the situation slightly from 2025, essentially locks in this disadvantage.

Some implications of CBAM

The analysis above suggests some important implications for EU steel mills that are listed below:

- CBAM will only come fully into effect in 2025. Before that time EU steel mills will remain significantly disadvantaged from a marginal cost perspective which will continue to restrict volume and profitability.

- While free allocations are in place, CBAM will not deliver a ‘level playing field’. This suggests a quicker elimination of the free allocations would be the most appropriate means to deliver this goal.

- As free allocations disappear, the full cost of carbon will be borne by both EU mills and importers and the above analysis implies that steel prices would need to rise by more than $300 /tHRC by 2035 if this cost increase is to be passed on. As a result, downstream manufacturing industries that consume steel will see a cost disadvantage. As such, a CBAM for manufactured goods may become a necessity.

If you want to discuss CRU’s work on carbon emissions, carbon pricing or the impact of carbon pricing on trade, pricing and investment decisions, please contact us using the details given. We will be happy to share our thoughts on these areas.

To find out how CRU’s value chain emissions analysis tools can help you benchmark emissions performance or to learn more about the asset-level data and emissions curves readily available on CRU's new interactive web-based platform, click here.

To receive email alerts to all CRU Sustainability Insights, please register your details here.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more