Weather events significantly disrupted commodity markets in 2022, fuelling already significant price volatility. La Niña has ended in Australia, but other weather events and permanent climate change continue to impact global commodity supply chains.

Weather – a significant disruptor in 2022

Heightened seasonal weather and extreme weather events disrupted multiple commodity markets in 2022.

Heavy rain in Brazil and Australia, caused by an unusual third consecutive La Niña event in the Pacific, disrupted mine operations in regions of global significance for iron ore, thermal coal and metallurgical coal supply. Meanwhile, heatwaves resulted in some of the hottest summers on record in China and Europe. Falling reservoir levels and rising river temperatures disrupted power generation at hydroelectric and nuclear power stations, leading to curtailment of power-intensive aluminium and lithium production in China. Crop yields in both regions also suffered from the heat. More in-depth analysis of 2022 weather disruptions can be found in our Insight published in October 2022: "Weather: A key factor in commodity markets".

Existing tightness in commodity and energy markets – which manifested following the pandemic and were further compounded by Russia’s invasion of Ukraine – amplified the significance of these weather-related disruptions in 2022. While supply disruption and price volatility are expected to lessen in 2023 as prices fall from highs seen in 2021 and 2022 it remains important to understand potential risks presented by weather.

End of La Niña improves Australian supply outlook

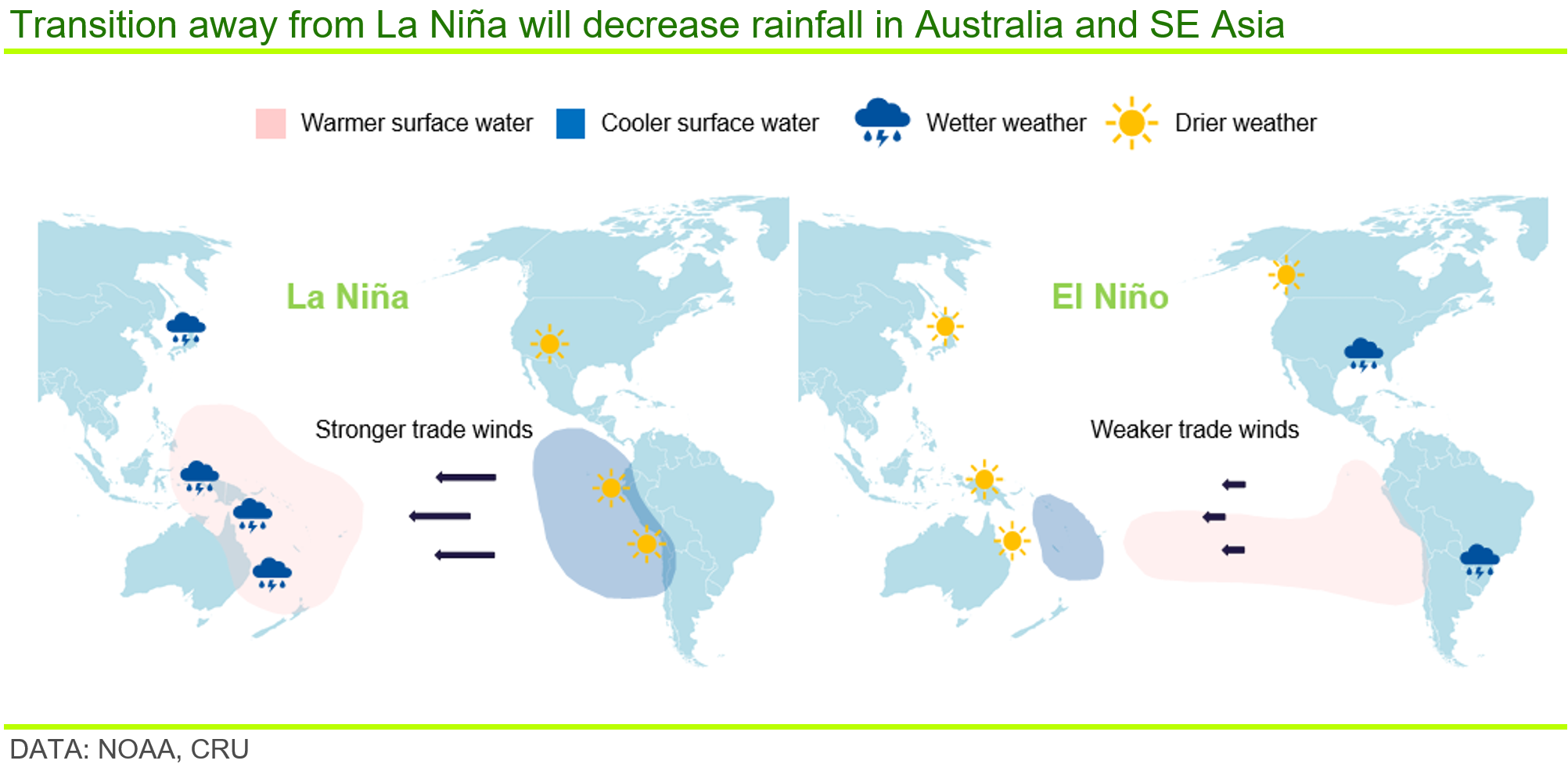

2023 marks the end of three consecutive years of La Niña in the Pacific Ocean. However, rain-related disruption has continued into the start of 2023. La Niña is one phase of the El Niño Southern Oscillation (ENSO) where stronger than usual trade winds push hot surface water across to the western Pacific, resulting in heavier than usual rain in eastern Australia and SE Asia. Surface temperature anomalies indicate trade winds have eased and hot water distribution is shifting back towards an El Niño scenario, although formation of a full El Niño is yet to be confirmed. Should this occur, it is likely to be strong which would lead to some very strong weather effects during 2023 Q4–2024 Q4.

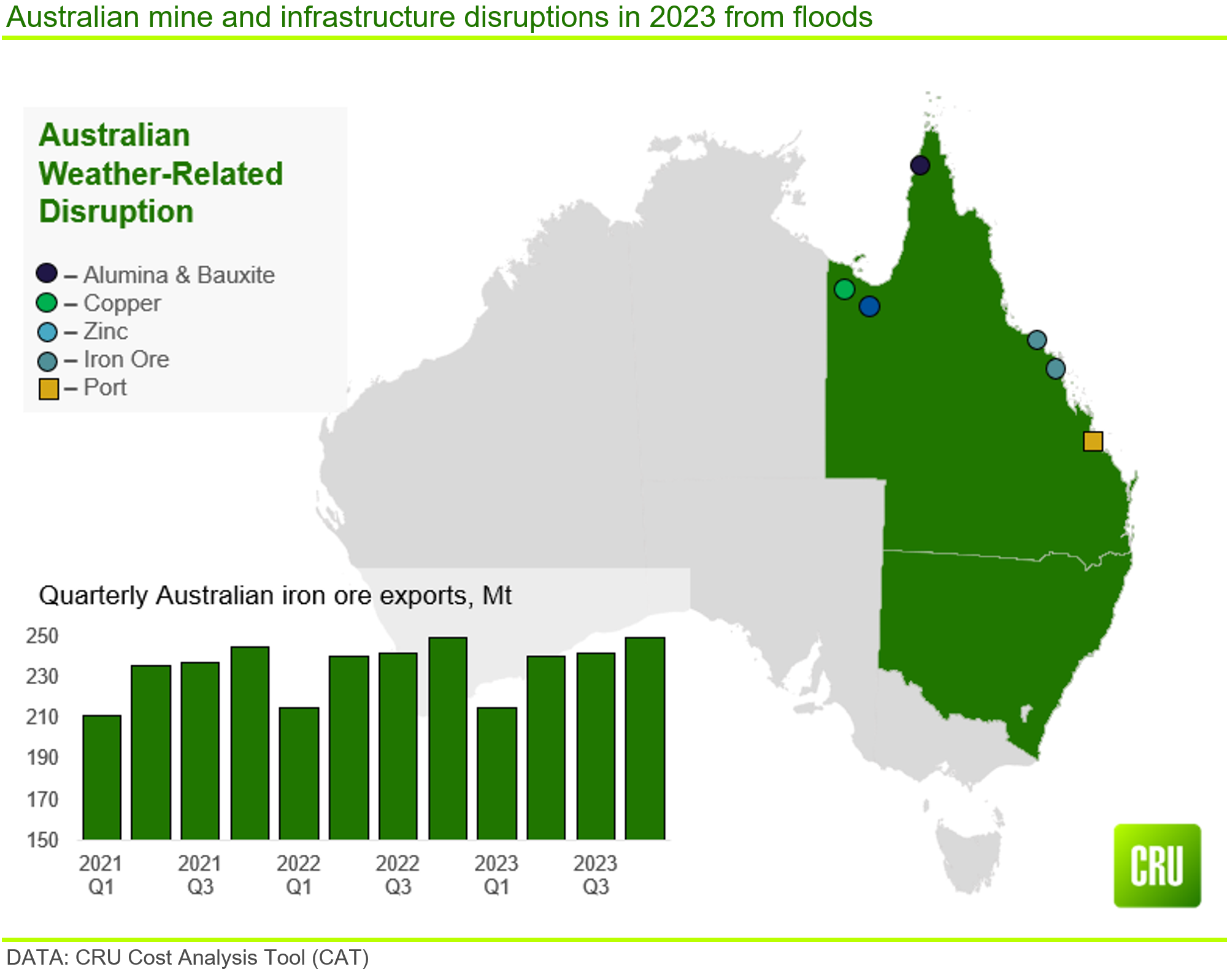

Three consecutive years of La Niña have severely disrupted mining in Queensland and New South Wales (NSW), which contain the majority of Australia’s producing coal mines. This disruption is globally significant as coal mines in these two states are expected to account for ~15% of global met coal supply, 181.5 Mt; and, ~4% of thermal coal supply, 217.9 Mt, in 2023. Disruption has not just been limited to coal – with east coast Australian base metal and bauxite mines also reporting weather-related disruption.

Disruption can also be seen beyond Australia, as La Niña boosted heavy rains causing landslides at PT Freeport’s Grasberg mine in Indonesia in February 2023. With La Niña now passing, many markets are expecting stronger supply from Australia’s mines in the coming year. It is, however, worth noting that a transition into a full El Niño weather system could result in water scarcity and droughts in eastern Australia and SE Asia.

Does 2023 mark the end of significant rain disruption?

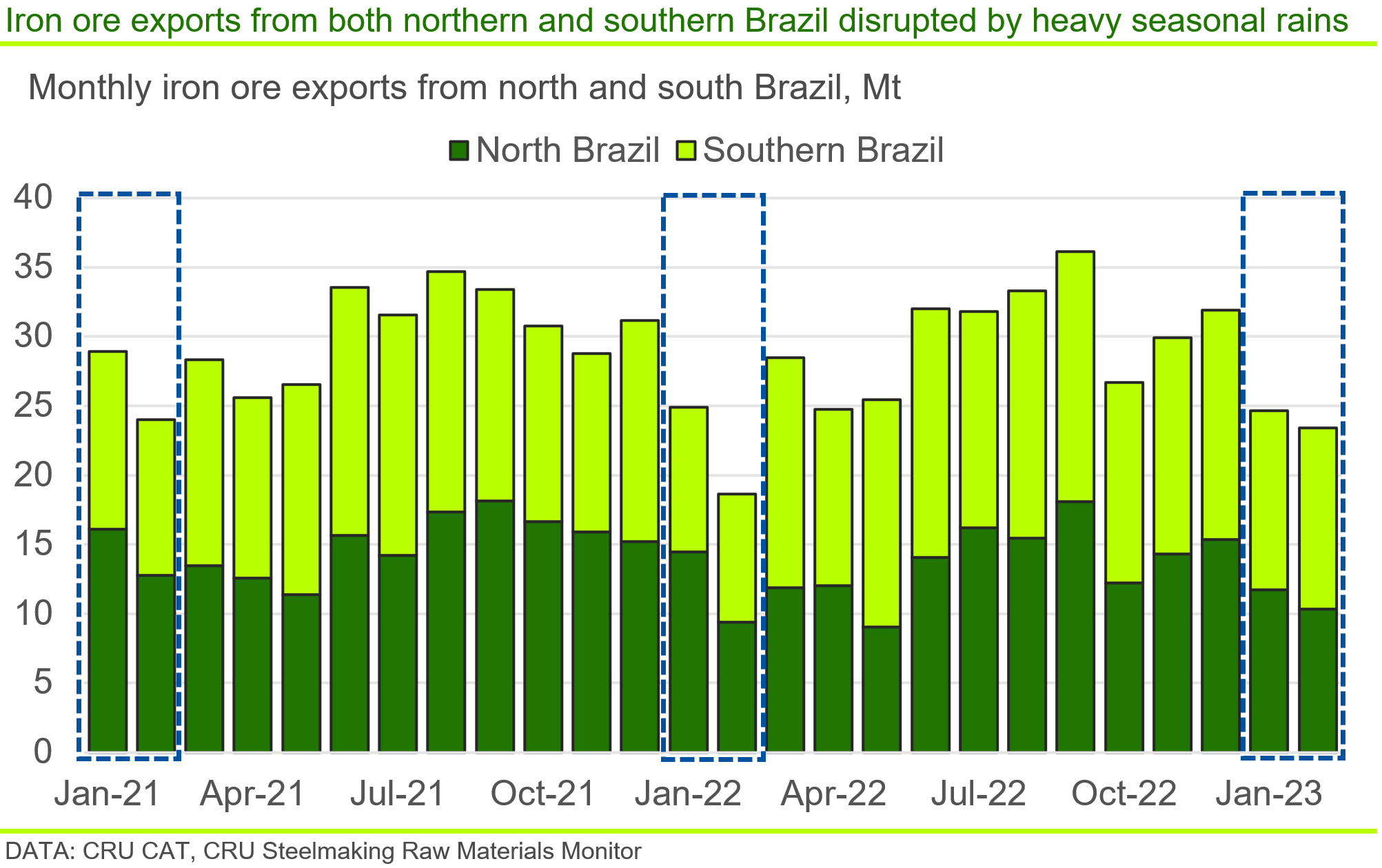

While the end of La Niña improves supply outlook for mines on Australia’s east coast, heavy rains in Southern Brazil are expected to remain as a disruptor to iron ore supply.

Brazilian iron ore production in the northern state of Pará was disrupted in January and February 2023, partly due to the waning but still present La Niña weather event. However, warming waters in the South Atlantic Convergence Zone – an area of the Atlantic Ocean that feeds weather systems in Southern Brazil – are now thought to be impacting precipitation over the key southern Minas Gerais mining district.

Iron ore mines in these two Brazilian states are expected to produce 576 Mt of iron ore in 2023, representing ~25% of global supply. The correlation between rising temperatures and increased rain in Minas Gerais is not yet confirmed. However, continued disruption to supply from this area of Brazil would contribute greatly to global iron ore market tightness.

Water scarcity also an issue in a warmer world

Reduced water availability has impacts across multiple commodity markets through lowering of crop yields, disruption to water-intensive mining and industrial processes as well as reduction in output from hydroelectric power stations.

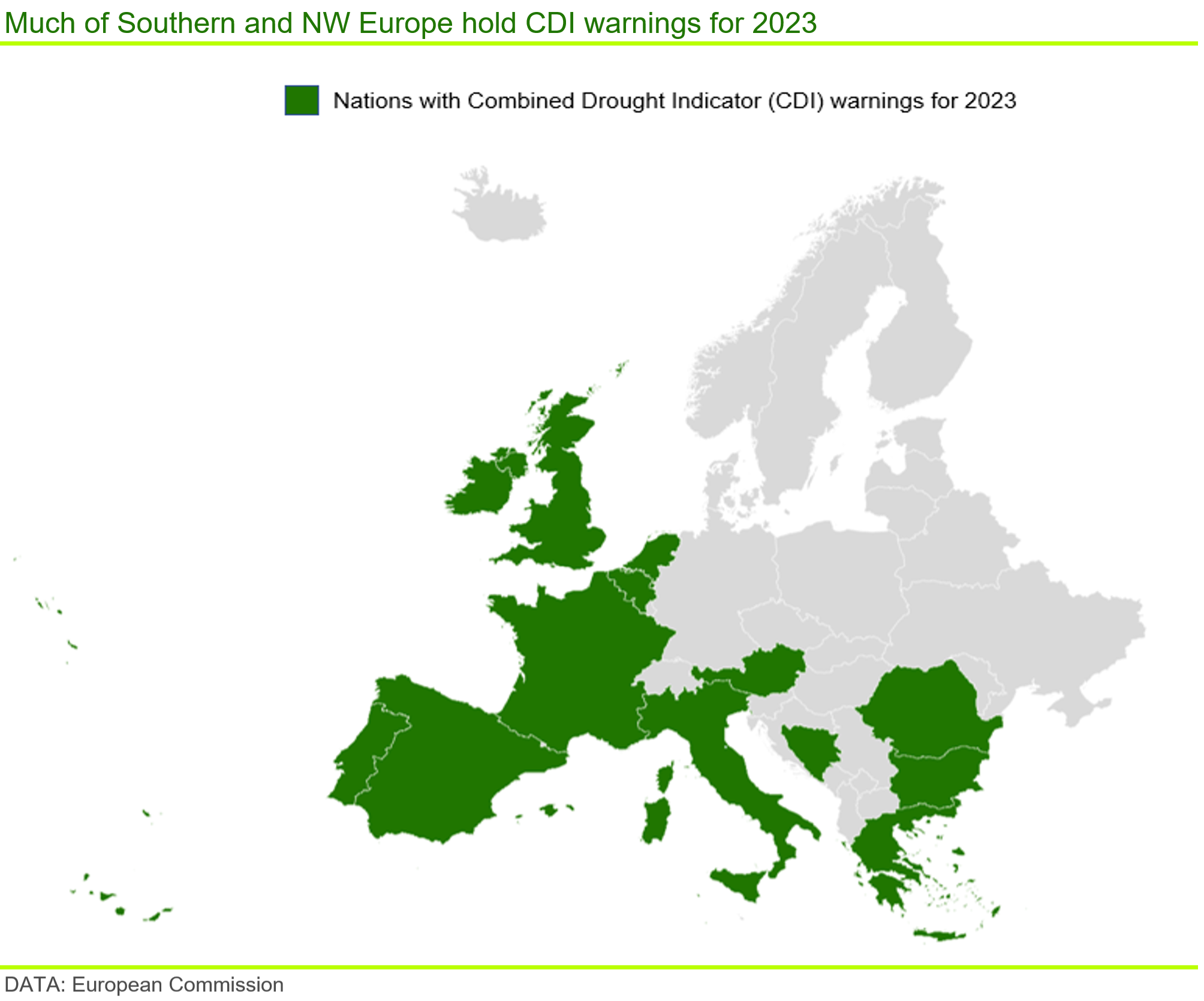

These disruptions were seen in the summer of 2022 in China and Europe, with disruption from water scarcity in these regions possibly extending into 2023. Groundwater levels were greatly reduced by the heatwaves in 2022. As a result, the European Commission has assigned combined drought indicator warnings to areas in 13 European countries. These warnings indicate that while water availability may not yet be an issue, temperature and precipitation anomalies in these areas are likely to persist in 2023.

On a wider scale, climate change and rising temperatures have increased the number of regions afflicted by acute and prolonged water scarcity.

Water availability remains a key issue for copper miners in Chile who are finding themselves in more conflict with local people over diminished water reserves. While rainfall in Chile was reduced by the recent extended La Niña event, rainfall volumes have been below normal for the past 15 years, which indicates a more serious water scarcity issue linked to larger scale climate change.

Chile is one example of a wider trend of precipitation anomalies seen across the globe from rapid desertification of the Sahel in Africa to rampant wildfires in the US and Australia. The impacts of the damaging effects of these changes in environment is expected to increase in coming years.

El Niño may flip regional conditions for crop production

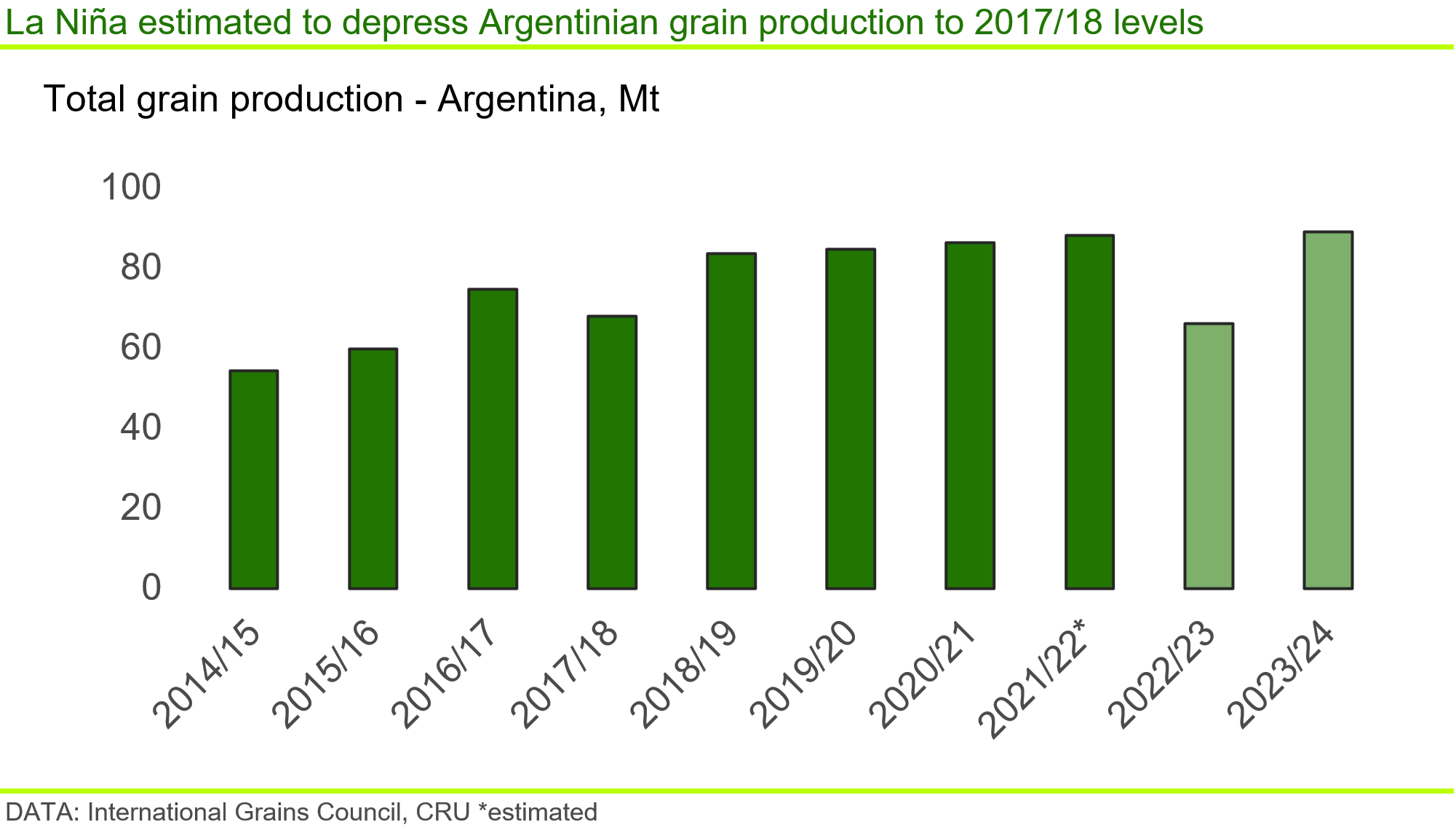

The 2022/23 growing season for soybean, corn, rice and wheat was heavily impacted by the La Niña event, which brought significant drought to a number of regions but optimal conditions to others.

In South America, Argentina experienced a devastating drought and high temperatures that caused the worst corn and soybeans crops for more than a decade. Soybean production is down 39% from last year and is estimated to be 27 Mt for 2023. Corn production is down 25% from last year and is estimated to be 37 Mt for 2023. Southern Brazil was also negatively affected.

In contrast, regions further north in Brazil benefitted from optimal weather conditions leading to the production of record soybean and corn crops. Furthermore, in Russia, 2022 saw record wheat crop production of more than 100 Mt following excellent growing conditions during the summer of 2022.

The prospect of the replacement of La Niña with El Niño in 2023 H2 presents shifting risks and opportunities for producers. CRU expects the switch will have a negative impact on crop production in the southern hemisphere while US winter crops may see some benefit for 2023/24 season.

Historical data shows that the effect of such a switch is not definite. In Australia, the impact of El Niño has not been consistent overtime – yields declined with 2009’s El Niño but were relatively unaffected following the El Niño of 2015. Moreover in India, all drought years have been El Niño years, but not all El Niño years have produced droughts.

Climate change – a threat in 2023 and beyond

Supply disruption and price volatility in commodity markets are expected to lessen in the medium term as prices fall from highs seen in 2021 and 2022. However, sudden demand increases from a resurgent China, increased interest in commodity markets following uncertainty in equities, or improved macro conditions in the EU and US could change that.

Regardless of global commodity demand, the localised impact of weather events means they are likely to continue causing regional supply disruption. The impact on global prices will depend on the global significance of supply from that region. It is well known that anthropogenic activity is resulting in global warming, with strong evidence indicating it is also increasing the frequency of extreme weather events. Weather events manifesting through climate change are becoming a significant, and increasingly regular, disruption to supply from key producing regions.

Find out more about our Sustainability Services.

Our reputation as an independent and impartial authority means you can rely on our data and insights to answer your big sustainability questions.

Tell me more